“Germany and Latin America have a long business tradition. German companies have been building an excellent reputation in the region for over a century. Brazil and Mexico are particularly attractive business partners for Germany”

The German economy is the fourth largest in the world and accounted for one quarter of the European Union’s GDP in 2020 (3,5B Euros). With a population of 84 million people, Germany is a key member of Europe’s economic, political, and defence organizations. The country benefits from a highly skilled labour force and is a leading exporter of machinery, vehicles, chemicals, and household equipment (The World Factbook). Its “social market” economy largely follows market principles, but with a considerable degree of government regulation and wide-ranging social welfare programs. The volume of trade, number of consumers, and a geographic location at the centre of the EU make Germany a cornerstone around which many Latin American firms and organisations can build their European and worldwide expansion strategies (International Trade Organisation).

Germany and Latin America have a long business tradition. German companies have been building an excellent reputation in the region for over a century. Brazil and Mexico are particularly attractive business partners. Population growth, increasing urbanisation and efforts to diversify economic structures offer opportunities for German businesses. There is also a demand for cutting-edge German technology in the areas of mining, renewable energies, environmental technology and health. The Business Association for Latin America offers a corporate network and information platform for German companies to launch and expand business in the region (German Federal Foreign Office). Federal Ministry of Economic Cooperation and Development (BMZ) focus its activities in LAC particularly on environmental and climate protection. Their aim is to promote a partnership for sustainable development based on the model of a social and ecological market economy (BMZ Latin America Policy).

Germany ranks 11th out of 27 EU Member States in the Digital Economy and Society Index (DESI) 2021. Regarding the index categories, Germany performs well in broadband connectivity. The country is a leader in 5G readiness (second in the EU in fixed broadband take-up) and very high-capacity network coverage has improved more than 20%. On Human capital, at least basic digital and software skills are widespread in the country and Germany reported the highest number of ICT specialists in 2020 (1.9 million specialists). Germany has also taken prominent measures to ensure digital transformation. In November 2018, the Federal Government published its implementation strategy ‘Shaping Digitalisation’ (DESI 2021 Germany).

The most important sectors of Germany’s economy in 2020 were industry (23.4%), public administration, defence, education, human health and social work activities (19.4%) and wholesale and retail trade, transport, accommodation and food service activities (15.8%). Intra-EU trade accounts for 53% of Germany’s exports (France 8% and the Netherlands 7%), while outside the EU 9% go to the United States and 8% to China. In terms of imports, 64% come from EU Member States (the Netherlands 14%, France, Poland and Belgium 6%), while outside the EU 8% come from China and 5% from the United States (European Union: Country Profile Germany).

Economic Forecast

In 2020 and 2021 Germany weathered the COVID-19 pandemic’s devastating economic effects better than any of its EU neighbours as a result of large part to its fiscal space, a large current account surplus (EUR 232 billion in 2020), generous economic stimulus packages, and flexible short-term work schemes that kept unemployment at only 5.7% in summer 2021 (International Trade Organisation).

The pandemic is likely to accelerate digitalisation with new business models and increases in demand for teleworking, telehealth services and remote learning. The energy transition requires changes in behaviour, consumption and production. In order to face these challenges while supporting the recovery, the OECD suggests that Germany needs to boost investment in infrastructure and knowledge-based capital, revive business dynamics and address skills bottlenecks (OECD Going for Growth Germany).

The economy is projected to grow by 4.1% in 2022 and 2.4% in 2023. Private consumption is accelerating in 2022 as consumer confidence improves. Solid investment will be underpinned by low interest rates and increasing capacity pressures. Inflation is likely to ease in 2022, but remain elevated (OECD, 2021). Demographic changes and resulting labour shortages, reduced capacity in supply chain, burdensome debt especially on the municipal level and higher energy prices due to the phase-out of coal and nuclear energy are factors that could dampen short-term competitiveness of the German market (International Trade Organisation). On the bright side, renewable energy sources are being favoured through an “Energy Transition”.

Germany’s military and energy policies have shifted in response to Russia’s invasion of Ukraine. Despite a heavy dependence on imported gas from Russia, the chancellor, Olaf Scholz of the Social Democratic Party (SPD), together with his coalition partners, the Greens and the liberal Free Democratic Party (FDP), has supported tough measures against Russia. The effects of the Ukraine war on the economy include higher inflation, higher fiscal spending (including on defence), manufacturing sector disruption, slower growth and possible technical recession in 2022 (The Economist).

Germany’s Science Technology and Innovation (STI) Landscape

The Global Innovation Index (GII) 2021 ranked Germany as the 10th most innovative economy (7th from the European Region) with performance above expectations for the country’s level of development. Germany was also on the top 5 both for scientific publications and research and development (R&D) expenditures. Finally, it ranks 3rd in human capital and research, with great investment in education, R&D and considerable number of graduates in science and engineering (GII 2021).

The financing system in Germany consists of five main actors: government, industry, foundations, private non-profit organisations and foreign donors, such as the European Union. The public sector, through the Ministry of Education and Research provides almost one third of all spending on research and development in Germany (Ministry of Education and Research).

The Federal Government and the Länder (state) finance funding organisations such as the German Academic Exchange Service (DAAD), the world’s largest funding organisation for the international exchange of students and researchers, and the Deutsche Forschungsgemeinschaft (DFG), whose main task is the selection and funding of the best research projects by scientists and scholars(Ministry of Education and Research).

The majority of funding however comes from the private sector. In 2018, business enterprises invested over EUR72 billion (two thirds) in R&D in the country. Industrial research is the main pillar outside the public sector and it contributes in specific fields through their own research institutes. The Federation of German Industries (BDI) is the umbrella organisation for more than 40 affiliated industrial associations.

In addition, there are more than 5,000 foundations incorporated under civil law in Germany that aim to promote science. The Stifterverband is an association of foundations, which in 2019 alone provided 17.2 million euros in funding for education, science and cooperation between business and science. Additionally, roughly 15.5 million euros are used to fund endowed chairs (Ministry of Education and Research).

The German Centre for Research and Innovation (DWIH) in São Paulo, Brazil, promotes visibility to the German innovation points, as well as synergy and exchange between institutions of both countries. As an important touchpoint between people and institutions from Brazil and from Germany in the areas of higher education, science, research and scientific innovation, DWIH São Paulo contributes through its work to a mutual sustainable, social and scientific development (DWIH São Paulo).

Some of Germany’s main research organisations are:

- Fraunhofer-Gesellschaft

- Helmholtz Association

- Leibniz Association

- Max-Planck-Gesellschaft

- Academies of sciences and humanities

- Federal institutions

- Länder (state) institutions

- Research infrastructure

- Industrial research

Germany’s National STI Priorities

Through education, research and innovation, the Federal Government is opening up future opportunities and promoting positive innovative drive. For instance, through the High-Tech Strategy 2025 (HTS 2025), the Federal Government, in a joint effort with the states’ authorities and the private sector, has set the goal of investing 3.5% of GDP in R&D by 2025. The strategy is intended to help put Germany at the forefront of the next technological revolutions in order to keep jobs and secure the country’s prosperity. HTS 2025 also creates scope for organising cooperation in the innovation process (HTS 2025).

With funds invested in R&D in 2018 amounting to 3.13% of economic output, Germany is already one of the most research-intensive economies in the world (OECD, 2021). The Federal Government’s research and innovation (R&I) policy systematically and continuously develops Germany’s future competencies based on technology, skills and the participation of society. According to the Report on R&I from 2020, there are six topics of national STI priority, all of which are closely related to ENRICH in LAC priorities.

- Health and care: Global health, personalised medical care, and combating cancer

- Sustainability, climate protection and energy: The path to CO2 -free hydrogen

- Mobility of the future: Intelligent and sustainable transport

- Safety and security: Entering an era of digital sovereignty

- Economy and work 4.0: Towards the future of work

- Urban and rural areas: Actively shaping structural transformation

Previous Contribution in Horizon 2020

In total 20.660 German organisations were involved in Horizon 2020 (now Horizon Europe) projects with a total of 10,11B Euro funding received by the project’s participants, making Germany the number one contributing country in terms of budget and participants. Structured by thematic priority, projects were conducted mainly within the frame of (Horizon 2020 Dashboards, state of June 2022):

- Marie Sklodowska-Curie Actions (3.370 participations)

- Information and Communication on Technologies (2.770 participations)

- Smart, green and integrated transport (2.120 participations)

- Health, demographic change and wellbeing (1.670 participations)

- European Research Council (1,610 participation)

- Secure, clean and efficient energy (1.520 participations)

- Food security, sustainable agriculture and forestry, marine and maritime and inland water research (991 participations)

- Climate action, environment, resource efficiency and raw materials (926 participations)

- Research Infrastructure (921 participations)

- Future and Emerging Technologies (899 participations)

- Advanced manufacturing and processing (630 participations)

- Innovation in SMEs (558 participations)

- Secure societies -Protecting freedom and security of Europe and its citizens (434 participations)

- Advanced materials (427 participations)

- Space (397 participations)

- Europe in a changing world-inclusive, innovative and reflective societies (351 participations)

- Euratom (215 participations)

- Nanotechnologies, Advanced Materials and Production (183 participations)

- Cross-theme (138 participations)

- Others

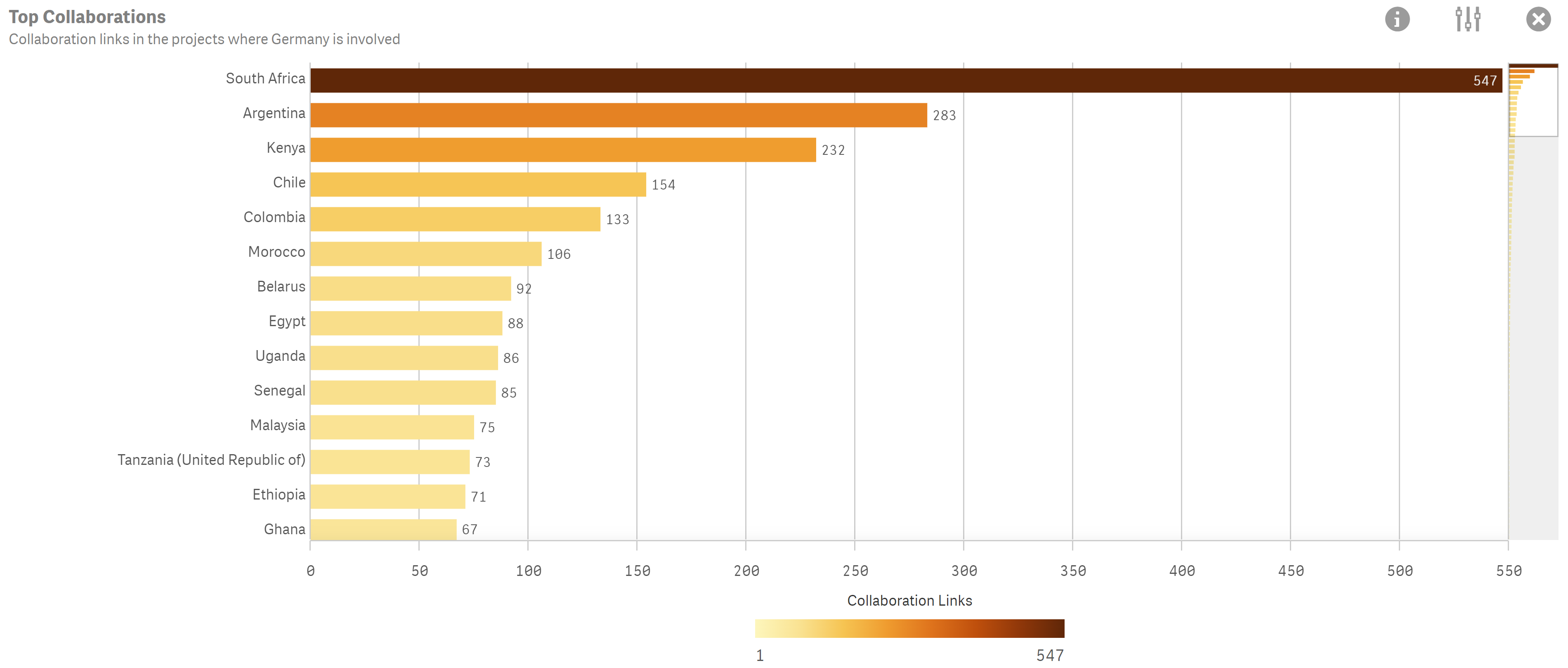

The three major organisations in terms of received funding were the FRAUNHOFER GESELLSCHAFT(670M Euro), MAX-PLANCK-GESELLSCHAFT (643,57M Euro) and DEUTSCHES ZENTRUM FUR LUFT UND RAUMFAHRT EV (347,55M Euro). The main collaboration links with LAC Countries of the Collaborative Country Group ‘Other Countries which get Automatic Funding’ are Argentina with 283 collaborations, Chile with 154 collaborations and Colombia with 133 collaborations (Horizon 2020 Dashboards, state of June 2022).

Regarding Germany’s SME Performance in Horizon 2020, 21.405 SME applied for H2020 project from which 3.780 SMEs were actually involved with a total net EU contribution of 1,31B Euro funding received (Horizon 2020 Dashboards, state of June 2022).

Funding Opportunities in Horizon EuropeHorizon Europe is the biggest EU research and innovation programme ever with €95.5 billion of funding available over 7 years (2021 to 2027). It is open to the world. This means that participants from all over the world can participate in most calls. In many cases, the EU will fund at least partly the participation of the international partners. As a member state of the EU, participants from Germany are automatically eligible for EU funding, unless specific limitations or conditions are laid down in the work programme and/or call/topic text. Most LAC countries are also eligible for EU funding as per the Horizon Europe participation rules. The list of eligible countries can be consulted in the Funding and Tenders Portal.